How Much Can You Contribute To A 401K In 2022

How Much Can You Contribute To A 401K In 2022. Individual plan participants can contribute up to $20,500 of their wages in 2022. Consider working with a financial advisor as you assess exactly how much you should contribute to your retirement fund.

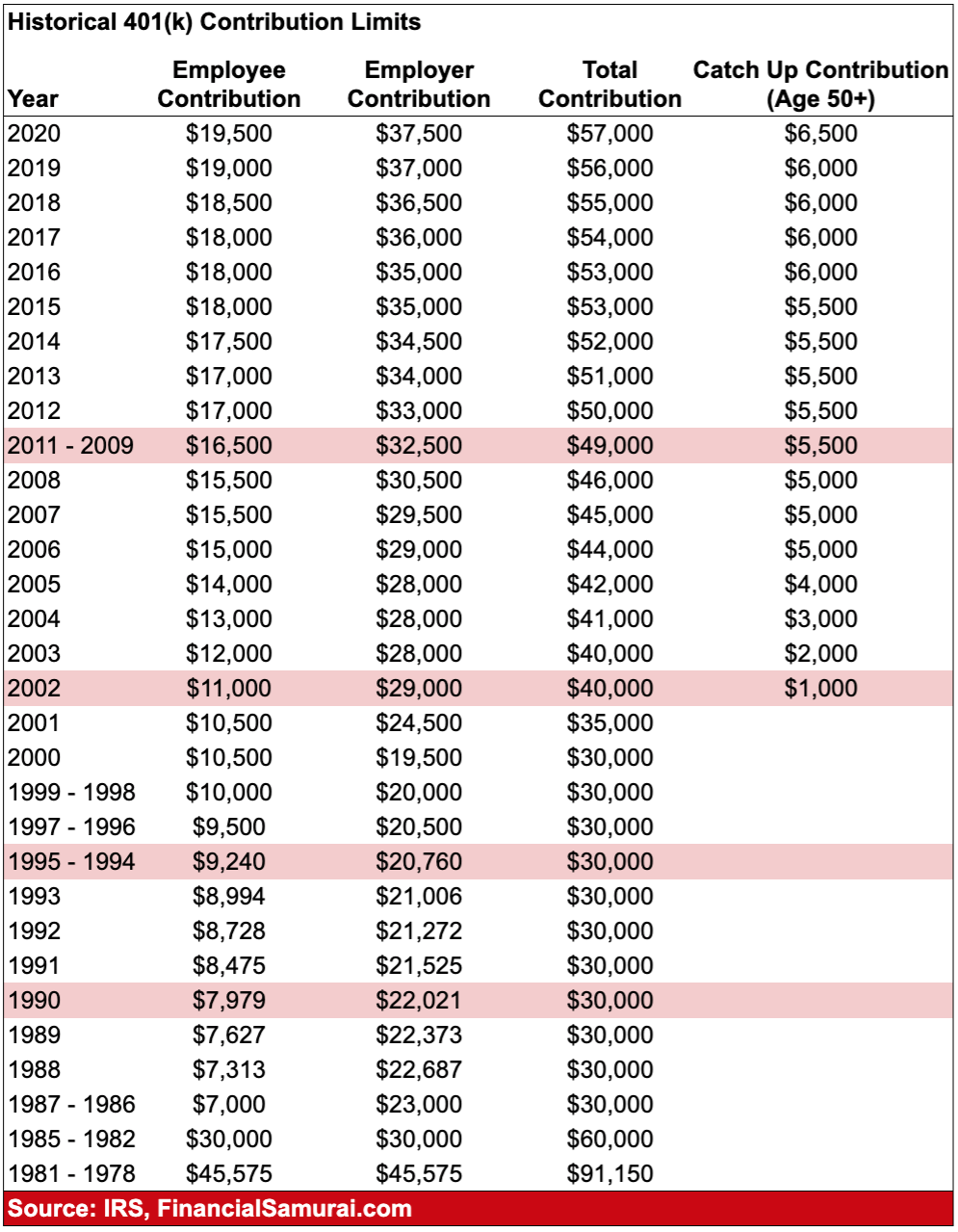

Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. 7 rows employees can contribute up to $19,500 to their 401(k) plan for 2021 and $20,500 for 2022. Qualifying for a 401(k) match is the fastest way to build wealth for retirement.

That Brings The Annual Total To.

7 rows employees can contribute up to $19,500 to their 401(k) plan for 2021 and $20,500 for 2022. The 401 (k) contribution limit is $20,500. Individual plan participants can contribute up to $20,500 of their wages in 2022.

Technically, This Means That Your Employer Could Contribute Up To $40,500 In.

The irs recently announced that the 2022 contribution limit for 401 (k) plans will increase to $ 20,500. The 401 (k) compensation limit will climb to $305,000. Consider working with a financial advisor as you assess exactly how much you should contribute to your retirement fund.

You Can Contribute To Both A Roth And A Traditional 401K Plan As Long As Your Total Contribution (As An Employee) Doesn’t Go Over $19,500 In 2021 And $20,500 In 2022.

Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. The 401 (k) contribution limit will increase to $20,500 in 2022. If you make less money, you may want to contribute more than 15% so that your nest egg will be larger when you retire.

Workers Who Are Saving For Retirement With 401 (K), 403 (B), Most 457 Plans, And The Federal Government's Thrift Savings Plan Can Contribute Up To $20,500 To Those Plans In 2022.

If you contribute to your 401k, you might wonder. This number only accounts for the amount you defer from. The contribution maximum for workers’ 401 (k) plans has been raised to $20,500, from $19,500 before.

The Contribution Limits For Particular Person Retirement Accounts (Iras) Stay Unchanged At $6,000.

The limit for employer and employee contributions will be $61,000. 401k contribution limits 2022 the contribution maximum for workers’ 401 (k) plans has been raised to $20,500, from $19,500 before. If you have an employer match, try to contribute enough to get the full company match.

Post a Comment for "How Much Can You Contribute To A 401K In 2022"